“Three hundred thousand days of access to safe drinking water for rural communities in Ethiopia.

”

★ We have reached an incredible milestone towards our giving goal of one million days!

★ This is another enormous step towards our giving goal, and it feels incredible to be able to give back to those communities that need it the most.

★ For 2021 and beyond, our giving goal is to provide 1 million days of access to clean water to families living in poverty in rural Ethiopia.

★ It is with thanks to our doctors, hospitals and practices who have made this happen.

“We link our day to day business activities to our giving goal of providing families access to clean water in rural Ethiopia. ”

Hand-dug Wells In Ethiopia

✓ The projects we are supporting fund the construction of hand-dug wells in the Ethiopian province of Tigray.

✓ During the current unrest in Tigray, the project areas have continued to run, but thousands of wells and water sources have been deliberately damaged or destroyed.

✓ It is crucial that we help to get these wells back up and running to their previous state. Without a well, women can spend 3 hours every day collecting about 20 litres (for her whole family) of polluted water from sources often shared with livestock.

✓ The whole family benefit from having access to clean water - meals can be prepared earlier, improved sanitary practices also mean less sickness and fewer missed school days.

Our Giving Stories

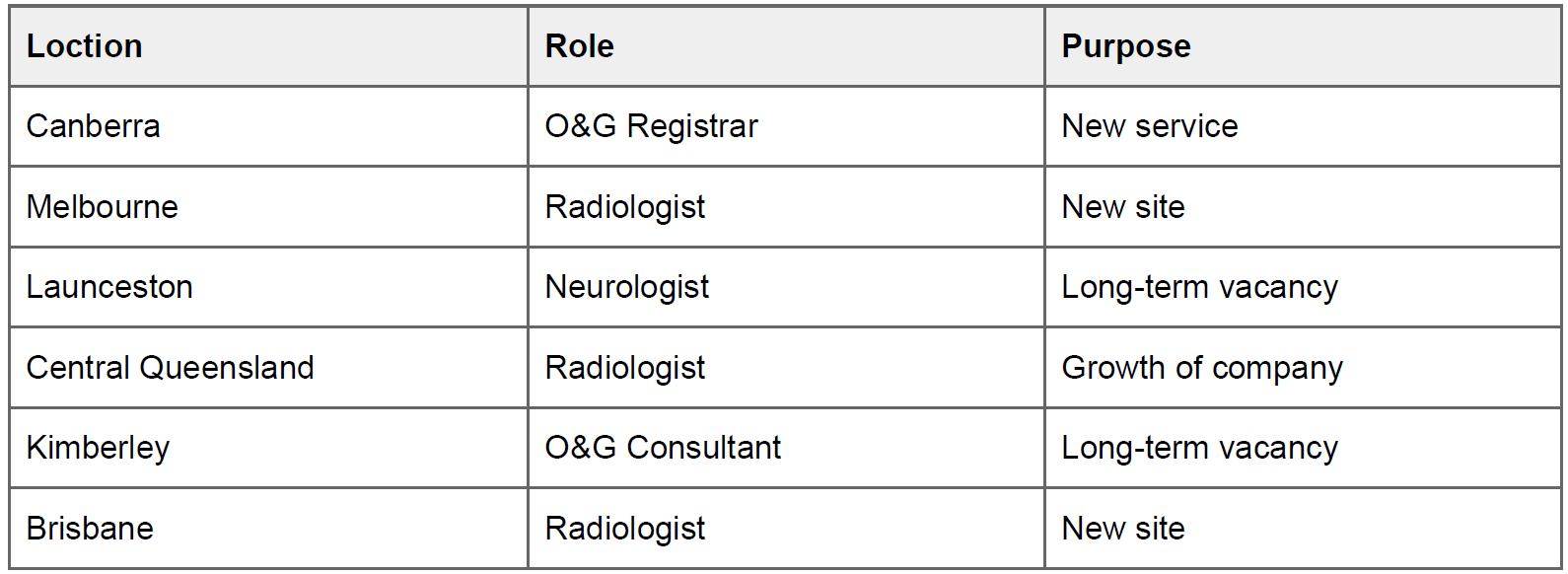

When the following things happen at Prescript, we give access to life-saving clean water:

➞ When a hospital or practice confirms a doctor in a locum or permanent position in regional Australia

➞ When a doctor refers another doctor to us

➞ When a doctor registers as a new candidate with Prescript

➞ When a doctor completes a reference for another doctor

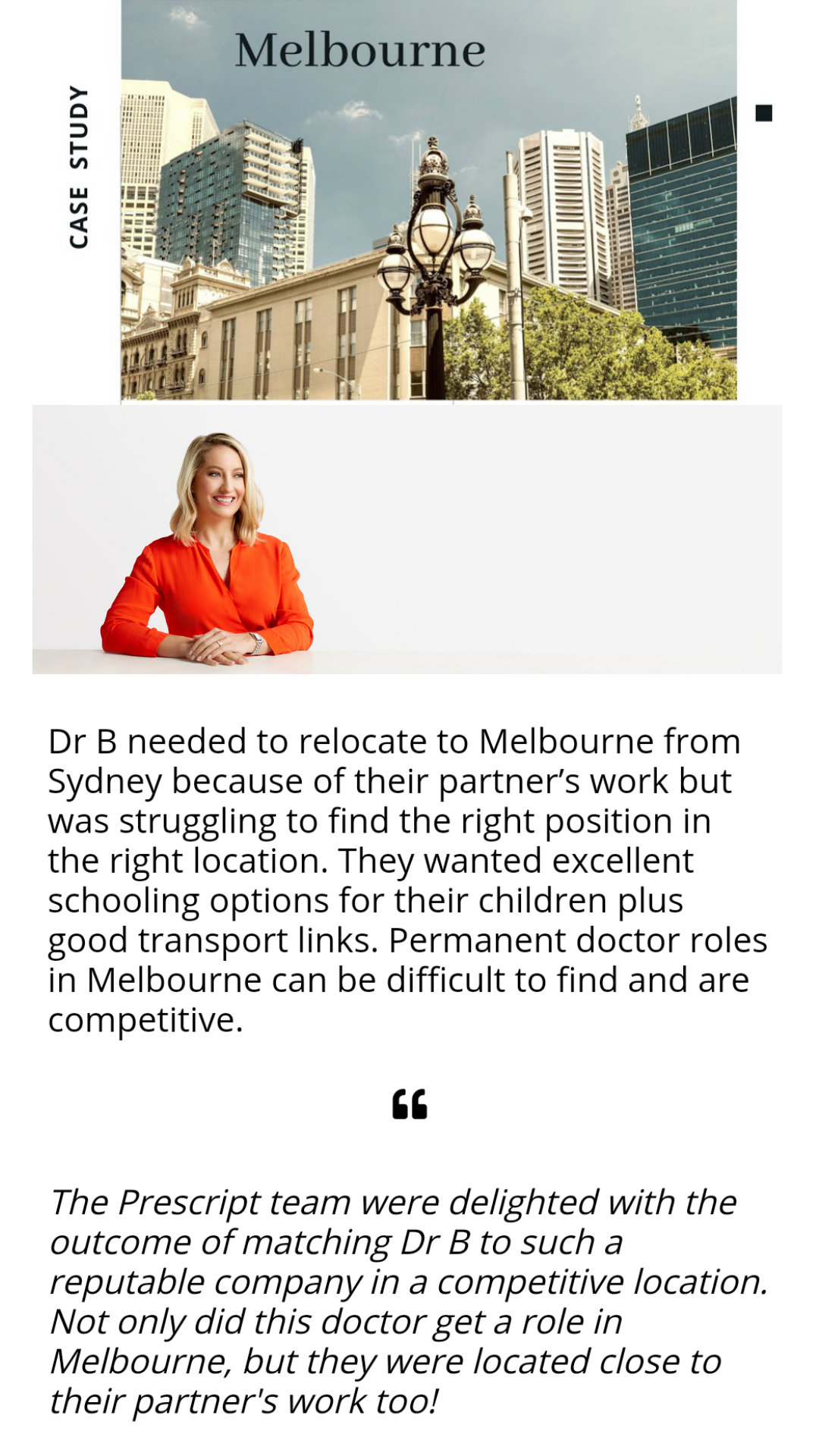

About Stef McLaughlin

Stef is Prescript’s Credentialing, Quality & Giving Manager, working with regional hospitals and practices across Australia to ensure that doctors start on time. Stef is responsible for Prescript’s quality management processes and our giving relationship with the Buy1Give1 programme.

There are three ways to contact Stef:

Call Stef on 0416 544 577

Email stef@prescript.com.au

Click 'Connect with Prescript'

“B1G1 is something I am extremely proud of. I am proud of what we have achieved and genuinely love that our work directly impacts lives, not just here within my home, Australia, but also overseas.

”

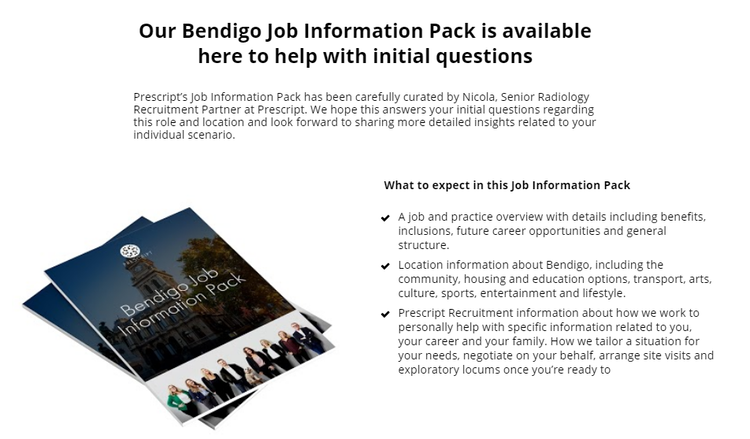

“Prescript are medical recruitment specialists.”

At Prescript we’re known for helping solve the regional doctor shortage in Australia.

Every day we’re focused on two clear outcomes - Helping hospitals find doctors that create departments and clinics that run better, have more capacity and less stress. And placing Doctors in jobs that leave them feeling highly valued, rewarded and, most importantly, enjoying what they do.

We believe that when we get these two crucial things right, it has a huge impact on the regional doctor shortage and the healthcare of communities across Australia.

There are three ways to contact us:

Call 1300 755 498

Email contact@prescript.com.au

Click 'Connect with Prescript'

We’d love to hear from you!

“We’re known for helping solve the regional doctor shortage, leaving doctors loving what they do and regional communities feeling like they have the best doctors in town.”